The Delhi government’s draft Electric Vehicle (EV) Policy 2.0 is shaking things up for car buyers and carmakers in the capital. One big rule says that if a household already owns two vehicles, their third vehicle must be an electric vehicle (EV). This is part of Delhi’s plan to have 95% of new vehicles registered as EVs by 2027 to fight air pollution. But what does this mean for car companies like Tata Motors, Mahindra, and Hyundai, compared to companies making traditional petrol and diesel cars (called ICE or Internal Combustion Engine vehicles)? And how will regular people afford EVs or deal with charging issues? Let’s break it down in simple terms.

What Is Delhi EV Policy 2.0?

Delhi’s EV Policy 2.0, set to start in April 2025, aims to make the city a leader in clean transport. The “third vehicle must be EV” rule targets families with multiple cars, pushing them to go electric. The policy also offers cash incentives, road tax waivers, and plans to build over 13,200 charging stations across Delhi. With air pollution being a huge problem—Delhi’s air quality often hits “hazardous” levels in winter—this policy is a bold step to reduce vehicle emissions.

Currently, Delhi has about 1 lakh EV four-wheeler registrations (as of FY25), but EVs make up only 2-3% of total car sales. The policy wants to boost this to 30% for private cars by 2030. So, who wins and who loses in this EV push?

Winners: EV-Focused Carmakers

1. Tata Motors

Tata Motors is a big winner. They’re India’s top EV maker, with a 71% share in the electric car market. Popular models like the Tata Nexon EV and Tiago EV are affordable (starting at ₹8 lakh) and have good range (300-400 km). The policy’s push for EVs will likely increase sales for Tata, especially since they’re investing ₹18,000 crore to launch new EV models by 2030. Experts like Shailesh Chandra, MD of Tata Motors, say they’re ready to “capitalize on the EV surge” with new SUVs and better customer service.

2. Mahindra & Mahindra

Mahindra is another strong player. Their XEV 9e and upcoming models from their Chakan plant (set to produce 200,000 EVs yearly by 2027) make them a key contender. Mahindra expects EVs to be 30% of their sales by 2030. The policy’s incentives, like subsidies up to ₹1.5 lakh per vehicle, will make their EVs more attractive to Delhi buyers.

3. Hyundai Motor India

Hyundai is catching up fast with models like the Creta Electric, which sold well in January 2025. They’re also partnering with Tata Power to build charging stations, which helps solve a big consumer worry. Hyundai’s global expertise and new launches planned for 2025 will boost their EV market share in Delhi.

Why They Win: These companies already have EVs in the market, and the policy’s rules favor them. Incentives and tax breaks will make their cars cheaper, and their focus on charging infrastructure gives them an edge.

Losers: Legacy ICE Manufacturers

1. Maruti Suzuki

Maruti Suzuki, India’s largest carmaker, is in a tough spot. They rely heavily on petrol and diesel cars like the Swift and Dzire, with EVs making up less than 2% of their sales. While they’re launching an EV in 2025, their late entry means they’ll struggle to compete with Tata and Mahindra. The policy’s push for EVs could hurt their sales in Delhi, especially for multi-car households.

2. Honda and Toyota

Honda has no EVs in India yet, and their petrol cars like the City and Amaze will lose appeal under the policy. Toyota, while strong in hybrids, has only a 16% EV production forecast for 2030, lagging behind Tata’s 46%. Both companies may see sales drop as Delhi buyers are forced to choose EVs.

Why They Lose: These companies are slow to shift to EVs, and the policy’s strict rules (like the third vehicle mandate) will push buyers toward competitors with ready EV options.

Mixed Bag: Hybrid Makers

Companies like Maruti Suzuki and Toyota are pushing for hybrid cars (which use both petrol and electricity) to get the same tax breaks as EVs under the policy. Recent posts on X show that Delhi’s draft policy might offer road tax waivers for hybrids priced below ₹20 lakh, which could help them. However, Tata, Mahindra, and Hyundai are opposing this, saying it dilutes the focus on pure EVs. If hybrids get included, Maruti and Toyota could gain, but if not, they’ll face bigger challenges.

Consumer Perspectives: Can People Afford EVs?

For Delhi’s car buyers, the policy brings both opportunities and challenges. Let’s look at the key issues:

Affordability: EVs are expensive upfront. For example:

- Tata Tiago EV: ₹8-12 lakh

- Hyundai Creta Electric: ₹15-20 lakh

- Petrol Maruti Swift: ₹6-9 lakh

The policy offers subsidies (up to ₹1.5 lakh) and road tax waivers, which can save buyers ₹2-3 lakh. Still, many middle-class families may find EVs out of reach. Auto analyst Puneet Gupta from SIAM says, “Subsidies help, but EVs need to hit ₹5-7 lakh to compete with petrol cars for mass adoption.” Lower-income buyers, like small business owners, may struggle to afford EVs as their third vehicle.

Charging Infrastructure Challenges

Delhi plans to install 13,200 charging stations by 2027, with one every 5 km. But right now, there are only about 2,000 public chargers in India, and Delhi’s share is small. This worries buyers, especially those in apartments without private charging. A Delhi resident, Priya Sharma, shared on X: “I’d love an EV, but where do I charge it? My colony has no chargers.” Companies like Tata Power and Hyundai are building more stations, but it’ll take time to meet demand.

Total Cost of Ownership

EVs are cheaper to run. Petrol costs ₹100/liter, while charging an EV costs ₹1-2 per km. Over 5 years, an EV can save ₹2-3 lakh in fuel. But the high upfront cost and lack of chargers make people hesitate. A poll on X showed 60% of Delhiites would consider an EV if charging was easier and prices dropped.

Data and Projections

- Current EV Penetration: Delhi has ~1 lakh EV four-wheelers (2-3% of total cars) in FY25.

- Projected Growth: With Policy 2.0, experts predict 10-15% EV penetration by 2027, reaching 30% by 2030.

- Sales Impact: SIAM estimates a 5-7% drop in ICE car sales in Delhi by 2027, with EVs gaining 20-25% market share.

Expert Insights

Vinod Aggarwal, President of SIAM, told Hindustan Times: “The third vehicle rule is bold, but affordability and charging infrastructure are critical for success. Carmakers need time to scale up EV production.” Analyst Amit Kaushik from ICRA adds, “Tata and Mahindra will lead, but legacy players like Maruti must act fast or lose Delhi’s market.”

What’s Next?

The policy is still a draft, and changes could happen before April 2025. If hybrids get tax breaks, Maruti and Toyota might soften their losses. For consumers, more subsidies and chargers are key to making EVs practical. Delhi’s push could set an example for other cities, but it needs to balance ambition with affordability.

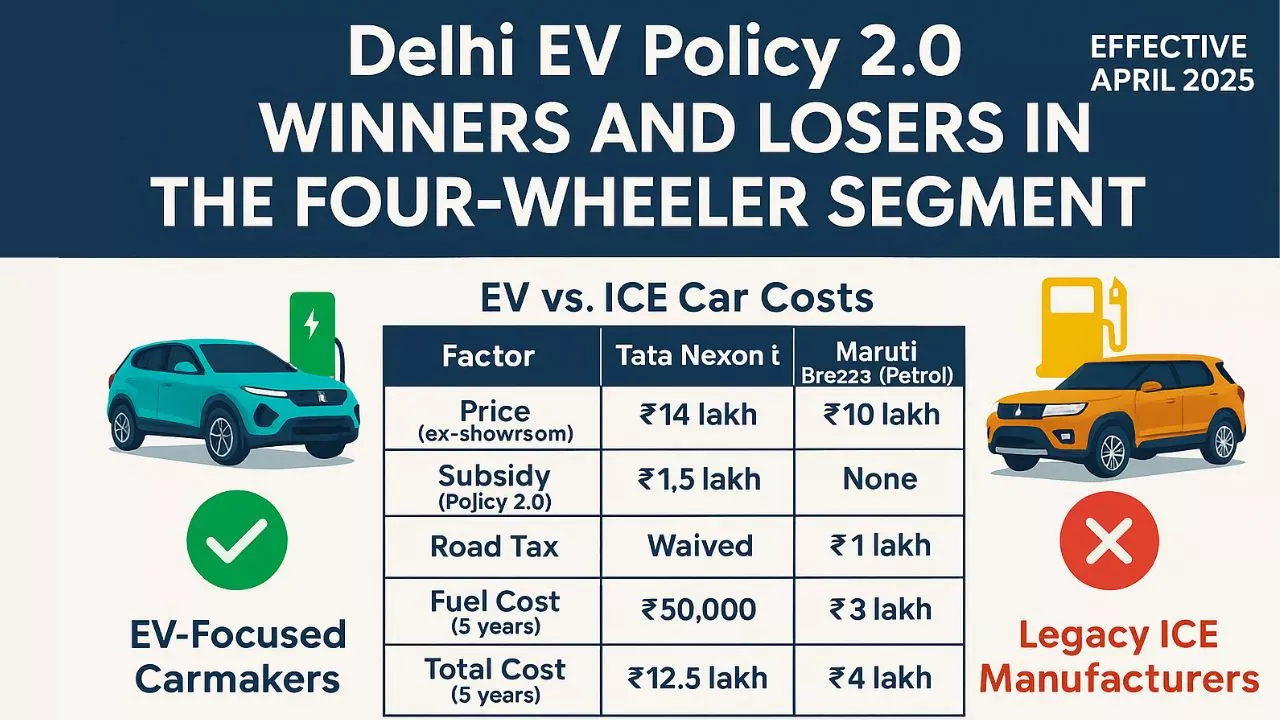

Infographic: EV vs. ICE Car Costs

| Factor | Tata Nexon EV | Maruti Brezza (Petrol) |

|---|---|---|

| Price (ex-showroom) | ₹14 lakh | ₹10 lakh |

| Subsidy (Policy 2.0) | ₹1.5 lakh | None |

| Road Tax | Waived | ₹1 lakh |

| Fuel Cost (5 years) | ₹50,000 | ₹3 lakh |

| Total Cost (5 years) | ₹12.5 lakh | ₹14 lakh |

Note: EV costs assume home charging; petrol at ₹100/liter.